|

|

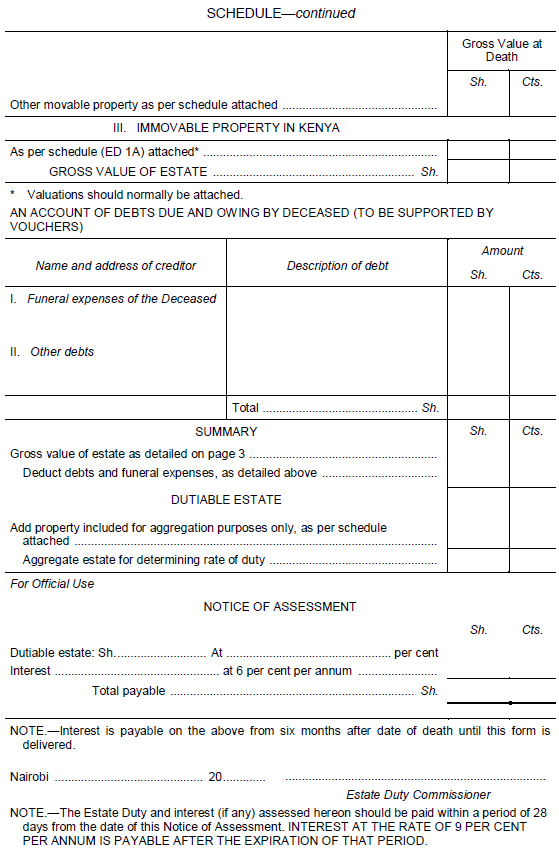

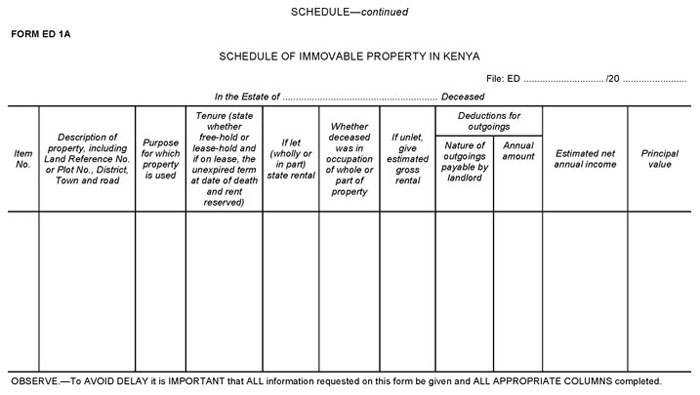

ESTATE DUTY (FORMS) RULES, 1963

[L.N. 554/1963.]

| 1. |

These Rules may be cited as the Estate Duty (Forms) Rules, 1963.

|

| 2. |

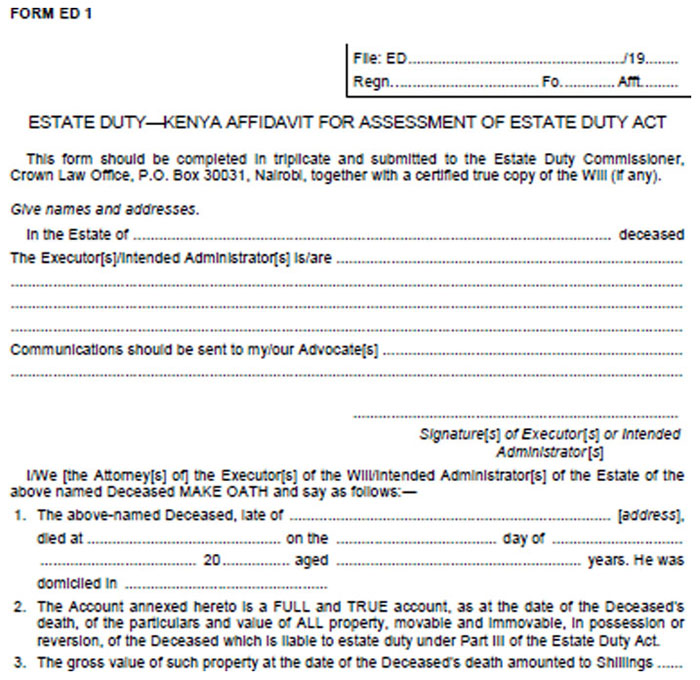

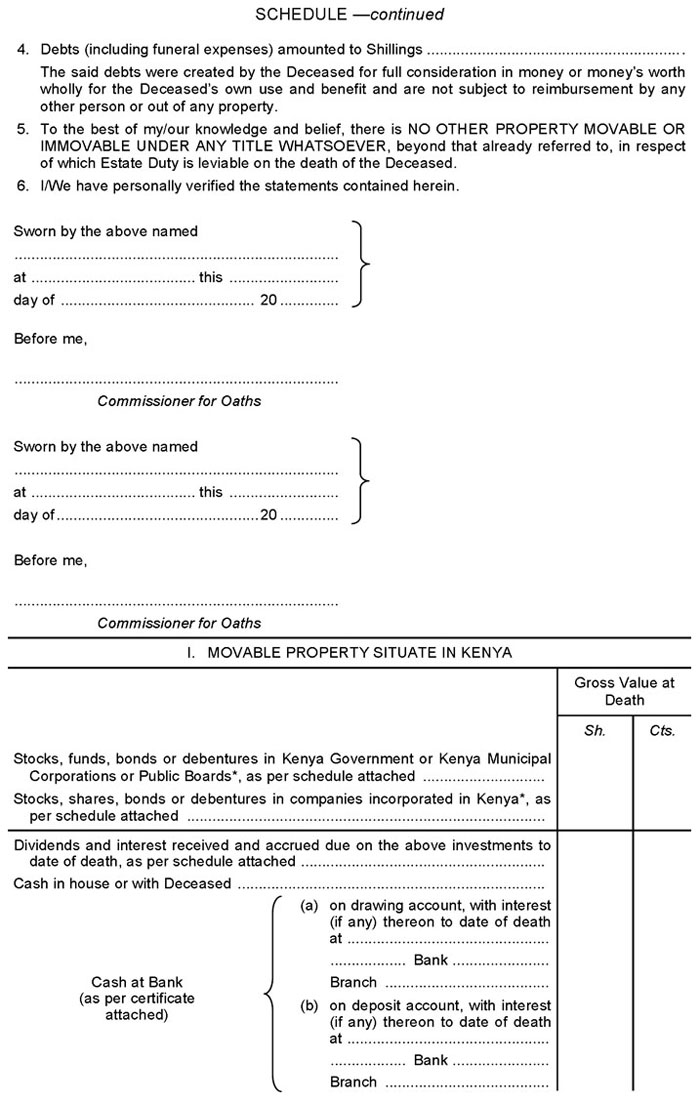

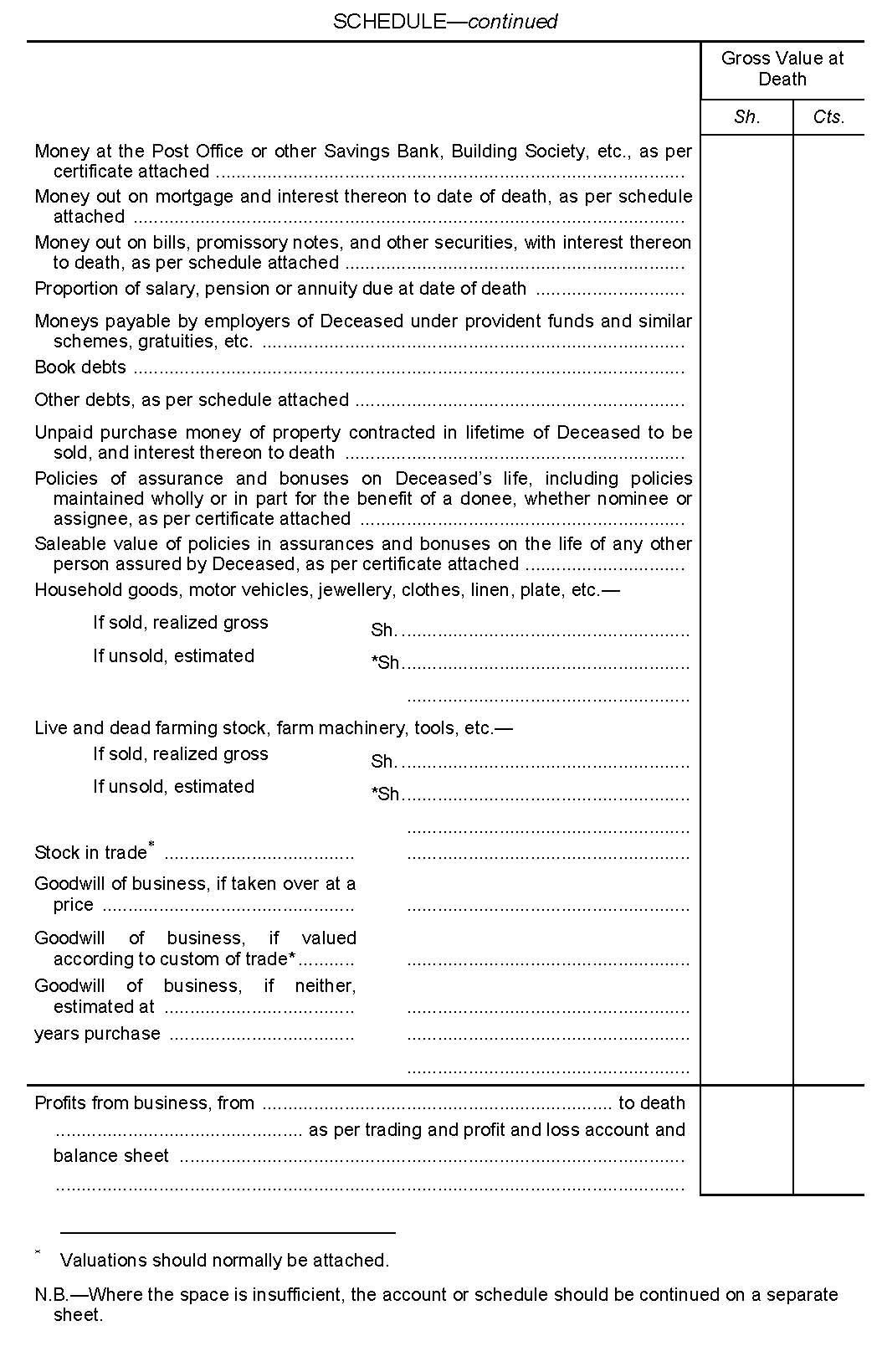

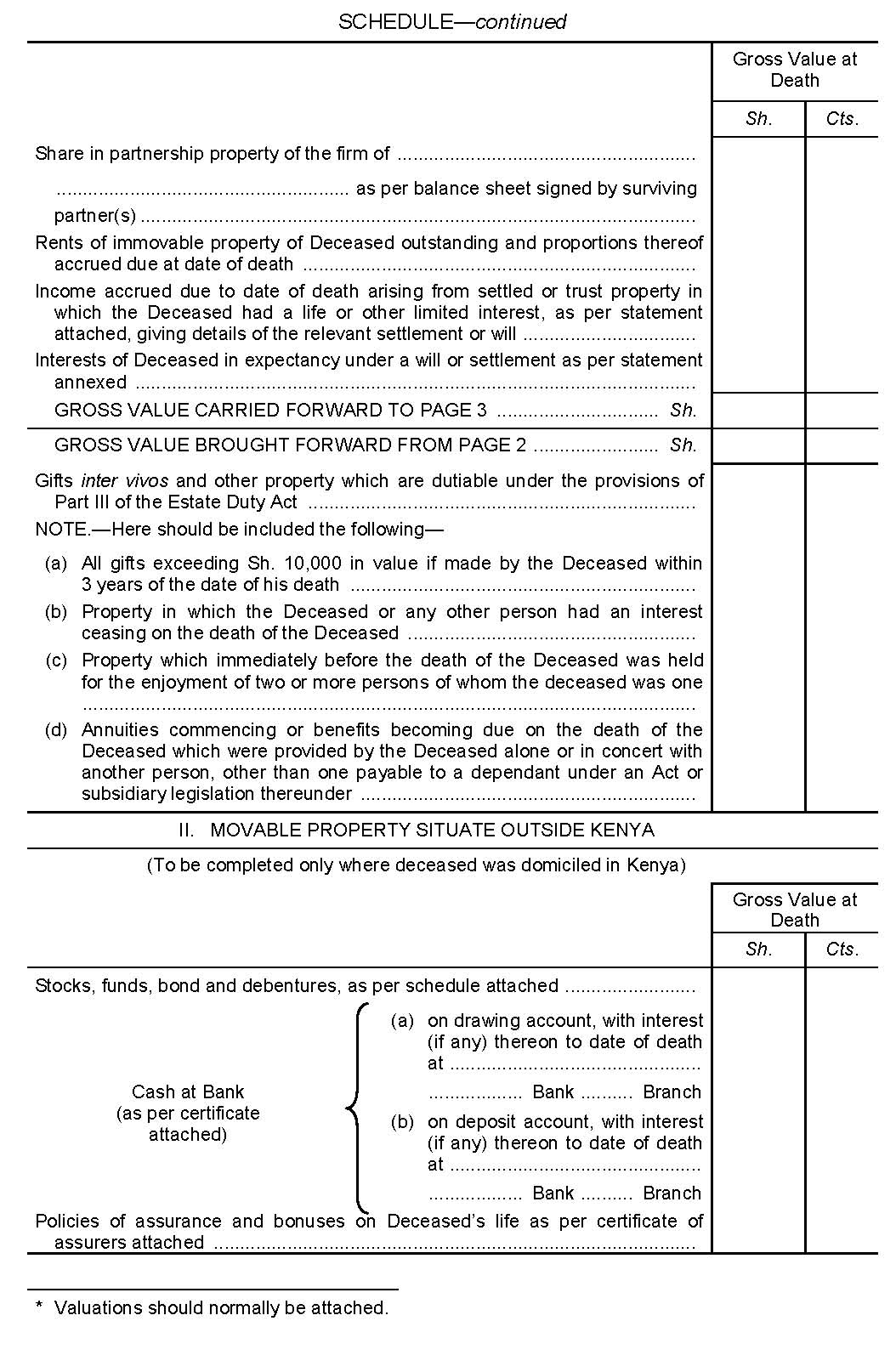

The affidavits and statements referred to in subsections (1), (2) and (5) of section 29 of the Act shall be in forms ED 1 and ED 1A, as the case may require, in the Schedule to these Rules and shall be furnished in triplicate.

|

| 3. |

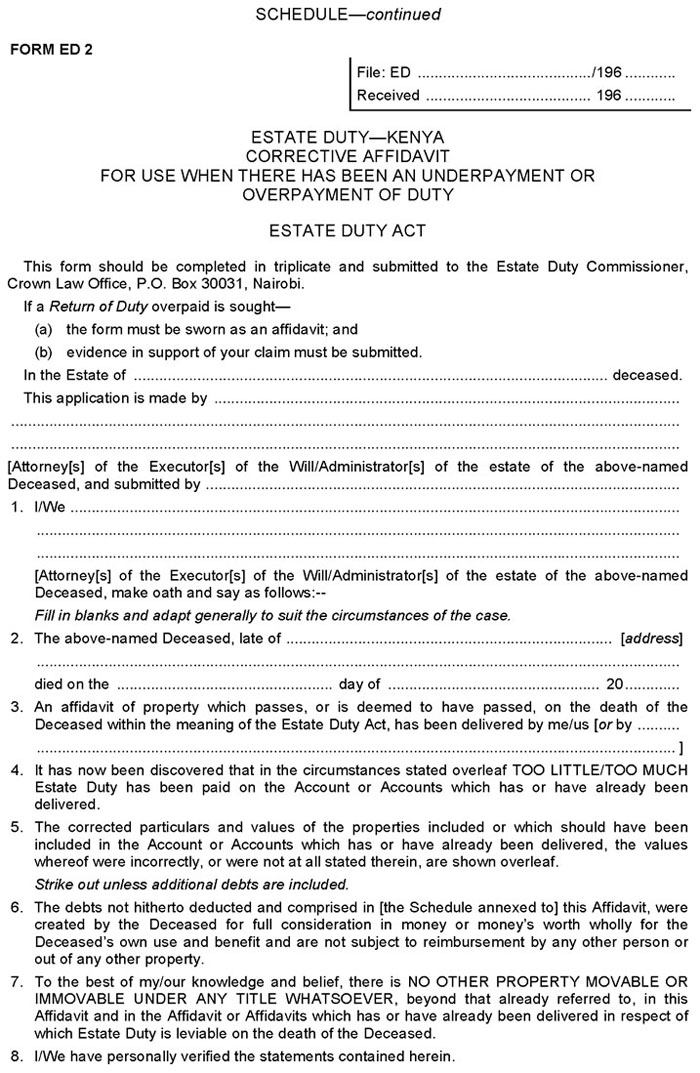

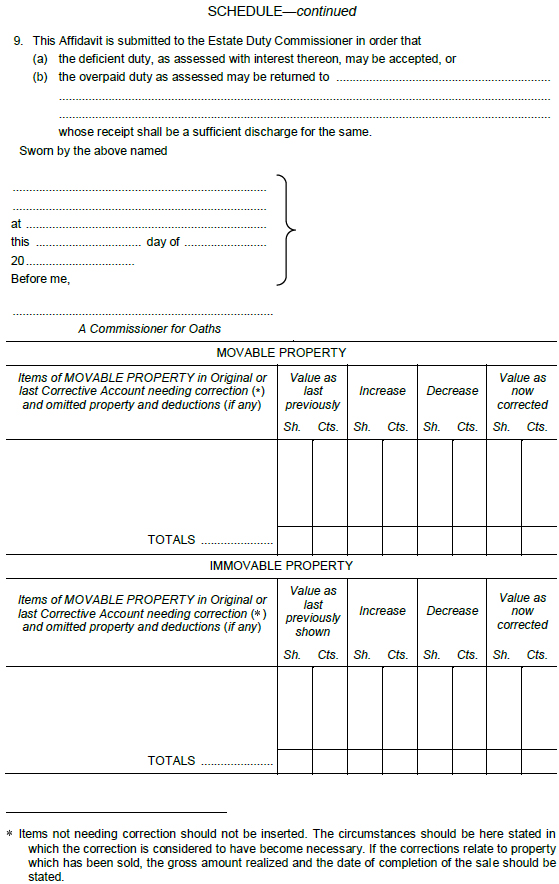

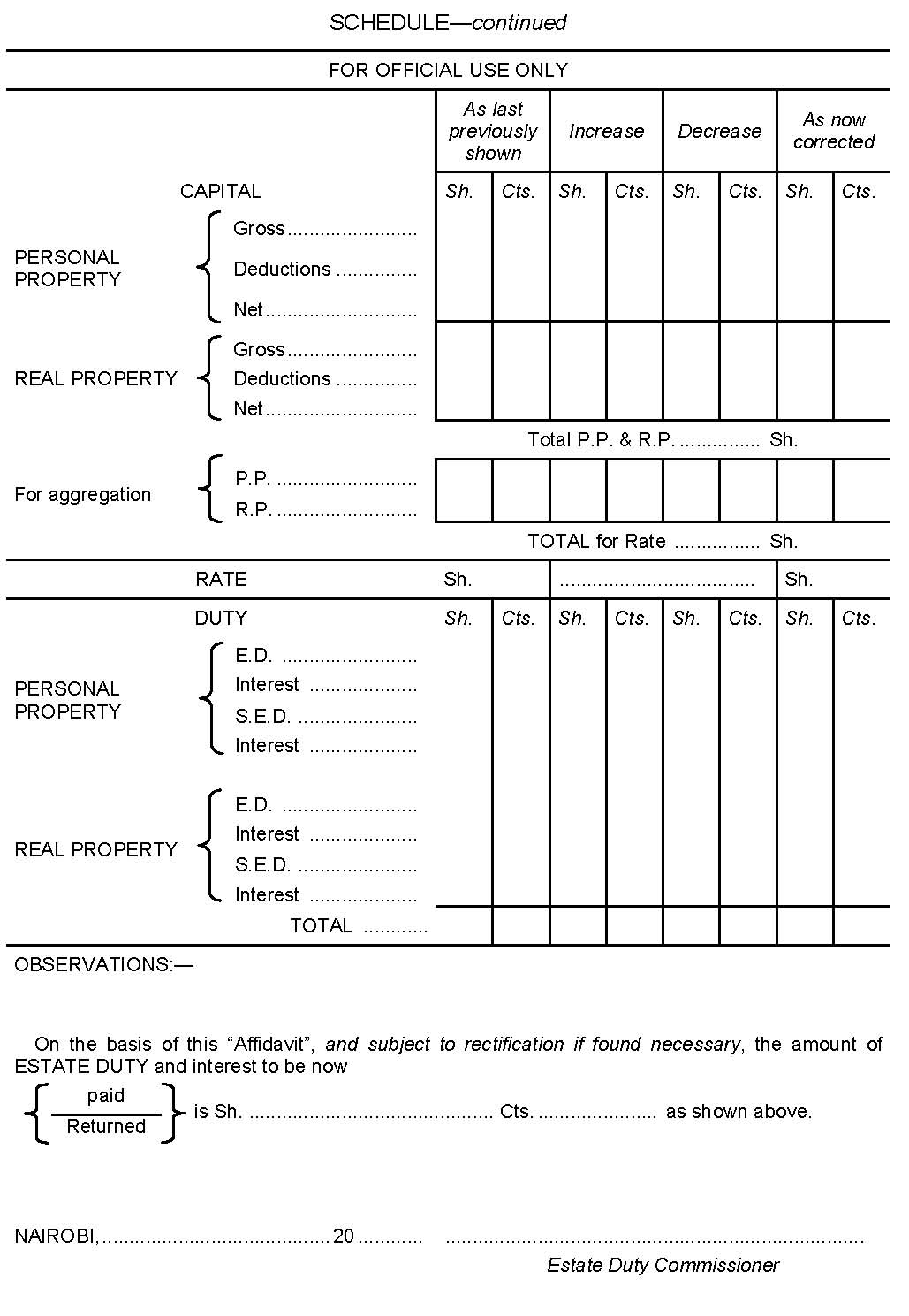

The corrective affidavit and statement referred to in section 29(4) of the Act shall be in form ED 2 in the Schedule to these Rules and shall be furnished in triplicate.

|

| 4. |

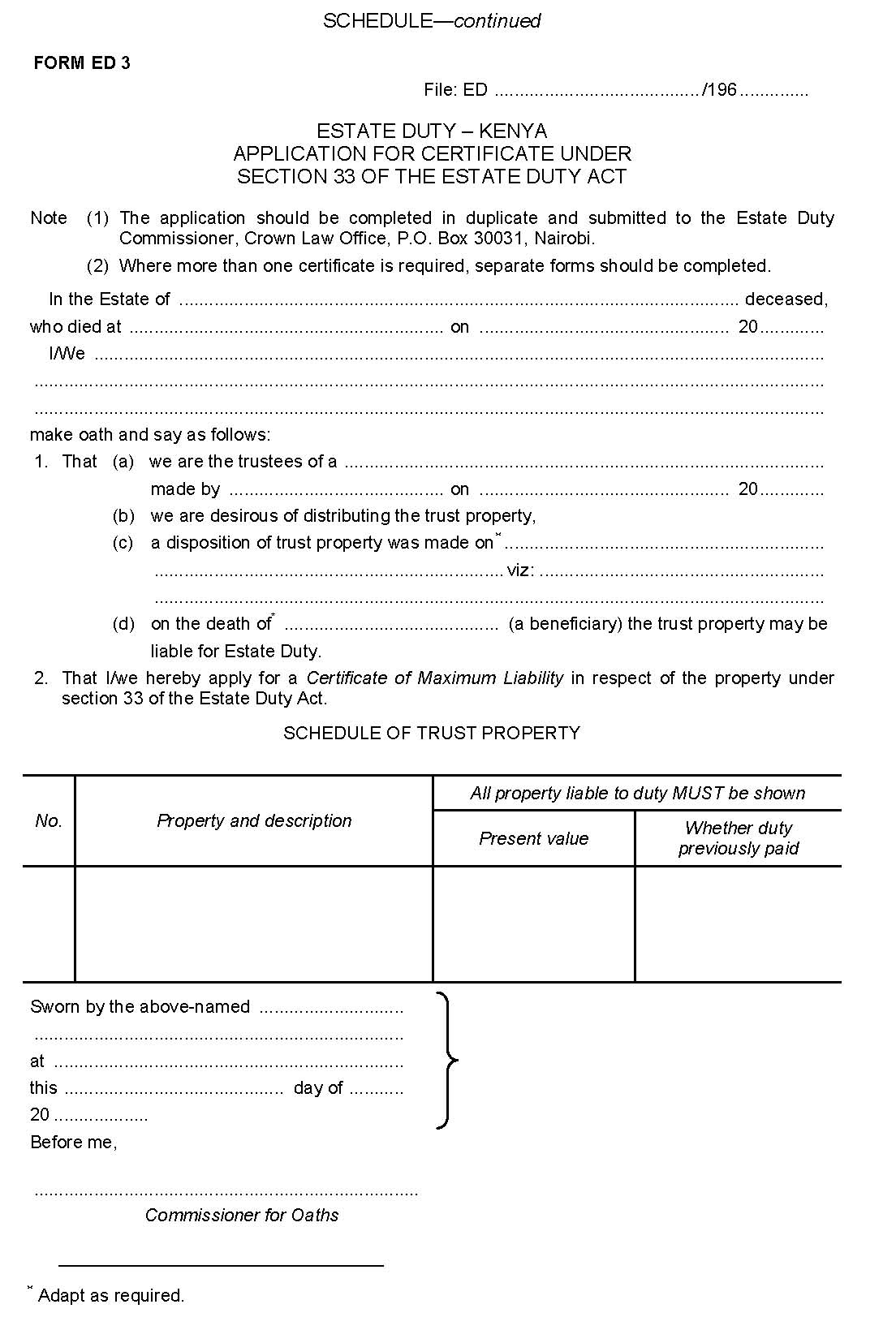

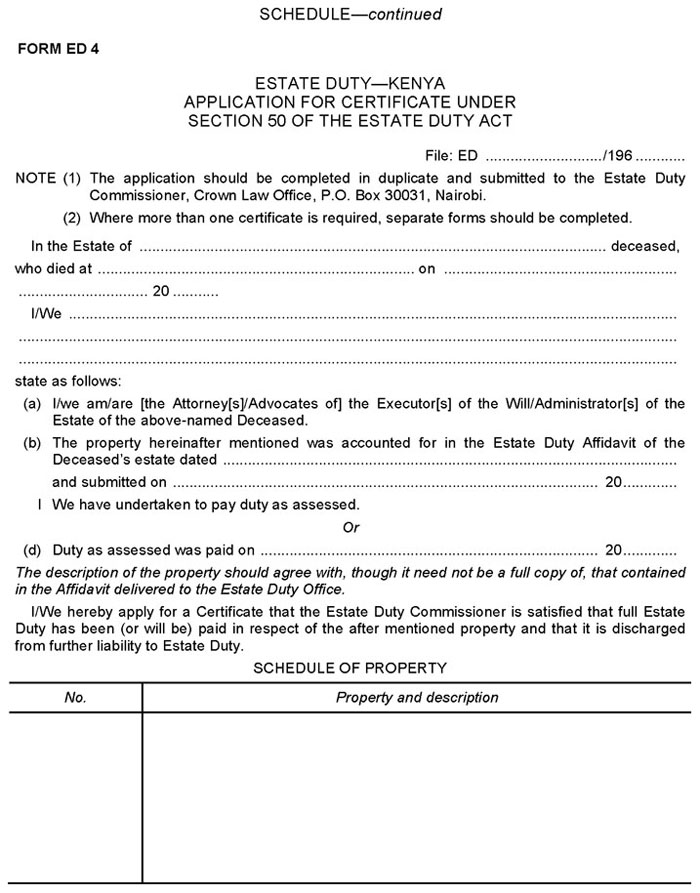

Applications for certificates under sections 33 and 50 of the Act shall be in forms ED 3 and ED 4 respectively in the Schedule to these Rules and shall be made in duplicate.

|

| 5. |

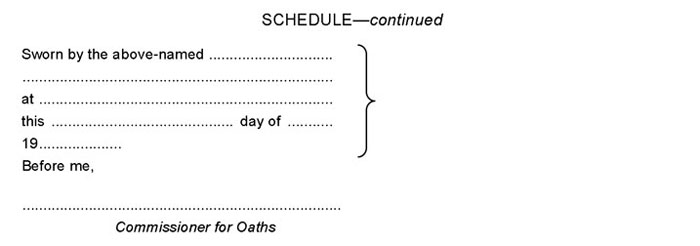

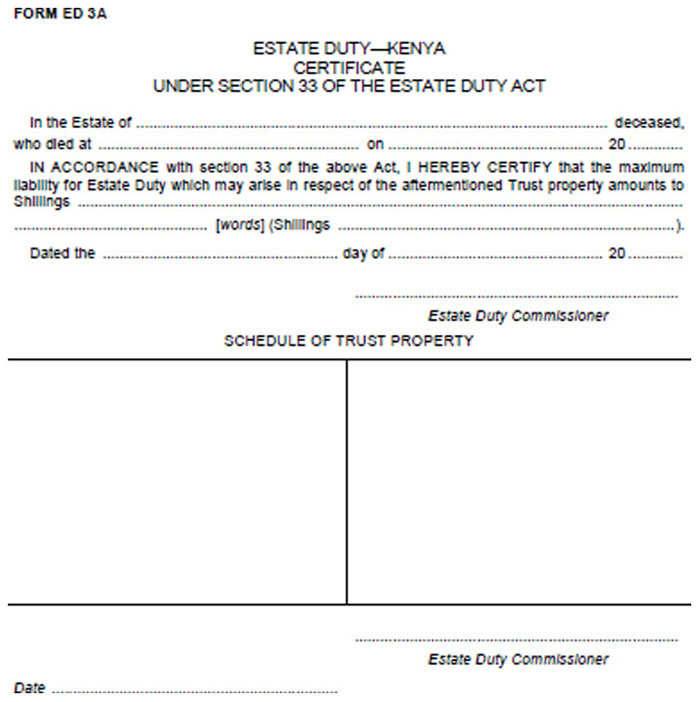

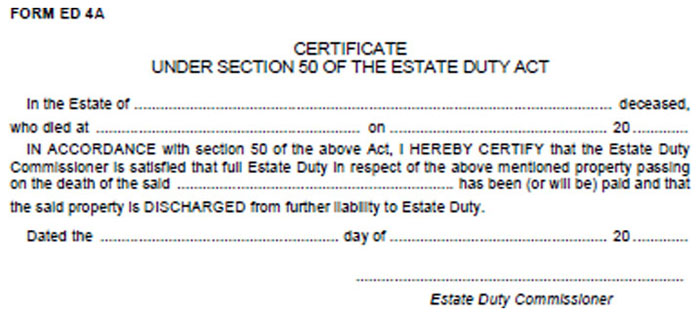

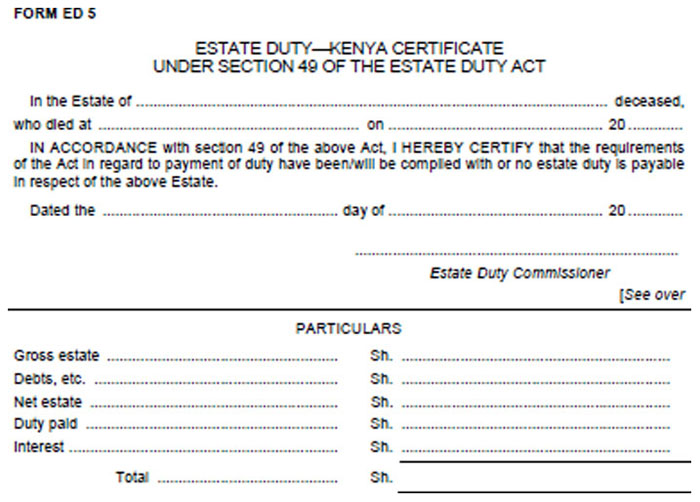

Certificates under sections 33, 49 and 50 of the Act shall be in forms ED 3A, ED 4A and ED 5 respectively in the Schedule to these Rules.

|

ESTATE DUTY (VALUATION APPEALS TRIBUNAL)

(PROCEDURE) RULES, 1964 [L.N. 383/1964.]

IN EXERCISE of the powers conferred by section 56 (d) of the Estate Duty Act, the Minister for Finance hereby makes the following Rules—

| 1. |

These Rules may be cited as the Estate Duty (Valuation Appeals Tribunal) (Procedure) Rules, 1964.

|

| 2. |

In these Rules, unless the context otherwise required—

“appellant” means a person who, under section 28(1) of the Act has the right of appeal to the Valuation Appeals Tribunal and includes his advocate or agent;

“Chairman” means the Chairman of the Valuation Appeals Tribunal;

“Commissioner” means the Estate Duty Commissioner appointed under section 3 of the Act and includes the Deputy Estate Duty Commissioner;

“secretary” means the Secretary to the Tribunal appointed under rule 3 of these Rules.

|

| 3. |

| (1) |

The Minister shall appoint a public officer to be secretary to the Tribunal.

|

| (2) |

The secretary shall in matters relating to appeals comply with the general and special directions of the Chairman.

|

| (3) |

The secretary shall, by notice in the Gazette, notify his address for the presentation or service of documents for the purpose of these Rules and shall in like manner notify any change in such address.

|

|

| 4. |

Every appeal to the Tribunal under the Act shall be preferred in the form of a memorandum of appeal and shall be presented to the secretary within one month after the date on which the appellant received notice of refusal by the Commissioner, or such further period as the Tribunal may allow.

|

| 5. |

The memorandum of appeal shall be signed by the appellant and shall set forth concisely the grounds on which the appeal is based.

|

| 6. |

The memorandum of appeal shall be accompanied by—

| (a) |

a statement of the facts of the case;

|

| (b) |

such submissions as the appellant may wish to make in support of his claim;

|

| (c) |

copies of any documents on which it is intended to rely.

|

|

| 7. |

Within seven days after the presentation of the memorandum of appeal to the secretary, a copy of the memorandum of appeal and the statement of facts of the appellant shall be served by the appellant upon the Commissioner and every other respondent.

|

| 8. |

| (1) |

On receipt by him of the memorandum of appeal, the secretary shall notify the Chairman of the receipt thereof.

|

| (2) |

The Chairman shall fix a time and date and place for the hearing of the appeal and the secretary shall cause a copy of the notice of hearing to be served on—

| (i) |

each member of the Tribunal;

|

| (ii) |

the Commissioner and every other respondent;

|

|

| (3) |

Unless the parties to the appeal otherwise agree, each party shall be entitled to not less than fifteen days notice of the time, date and place fixed for the hearing of the appeal.

|

|

| 9. |

| (1) |

On the hearing of an appeal the following procedure shall be observed—

| (a) |

the Commissioner and any other respondent shall be entitled to be present;

|

| (b) |

the appellant shall state the grounds of his appeal and may support it by any relevant evidence:

Provided that, save with the consent of the Tribunal and upon such terms as the Tribunal may determine, the appelant may not at the hearing rely on any ground of appeal other than a ground stated in the memorandum of appeal and may not adduce any evidence other than evidence previously adduced to the Commissioner;

|

| (c) |

at the conclusion of the statement and evidence on behalf of the appellant, the Commissioner and any other respondent shall be entitled to make such submissions, supported by such relevant evidence, as may be necessary to support his case;

|

| (d) |

the appellant shall be entitled to reply but may not rely on any ground of appeal or on any evidence other than that adduced at the hearing;

|

| (e) |

the Chairman or any member of the Tribunal shall be entitled at any stage of the hearing to ask such questions of the appellant or the Commissioner, or any other respondent, or any witness examined at the hearing, as he considers necessary to the determination of the appeal;

|

| (f) |

a witness called and examined by any party may be cross-examined by any other party to the appeal and, if so cross-examined, may be re-examined;

|

| (g) |

a witness called and examined by the Tribunal may be cross-examined by any party to the appeal;

|

| (h) |

the Tribunal may adjourn the hearing of the appeal for the production of further evidence or for other good cause, as it considers necessary, on such terms as the Tribunal may determine;

|

| (i) |

before the Tribunal considers its decision the parties to the appeal shall withdraw, whereupon the Tribunal shall decide the issue;

|

| (j) |

minutes of the meeting shall be kept and the decision of the Tribunal recorded therein.

|

|

| (2) |

Parties to an appeal may appear in person or may be represented by an advocate.

|

|

| 10. |

Save where the Tribunal in any particular case otherwise directs, or where any party to the appeal objects, copies of documents shall be admissible in evidence:

Provided that the Tribunal may at any time direct that the original shall be produced notwithstanding that a copy has already been admitted in evidence.

|

ESTATE DUTY (EXCHANGE OF INFORMATION)

(TANZANIA) ORDER, 1965 [L.N.

55/1965.]

WHEREAS arrangements have been made with the Government of the United Republic of Tanzania whereby the Estate Duty Commissioner of Tanzania shall, if so required, give such information as may be available to him and relevant to the assessment of the duty payable in respect of the estate of a deceased person to the Estate Duty Commissioner of Kenya, provided that no information shall be given which could disclose any trade secret or trade process:

NOW THEREFORE in exercise of the powers conferred by section 52 of the Estate Duty Act, the Minister for Finance hereby makes the following Order—

| 1. |

This order may be cited as the Estate Duty (Exchange of Information) (Tanzania) Order, 1965.

|

| 2. |

The Estate Duty Commissioner shall, if so required, give such information as may be available to him and relevant to the assessment of the duty payable in respect of the estate of a deceased person to the Estate Duty Commissioner of Tanzania:

Provided that no information shall be given which would disclose any trade secret or trade process.

|

ESTATE DUTY (FEES) RULES, 1966 [L.N. 187/1966.]

| 1. |

These Rules may be cited as the Estate Duty (Fees) Rules, 1966.

|

| 2. |

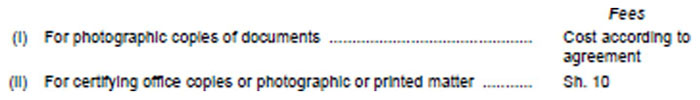

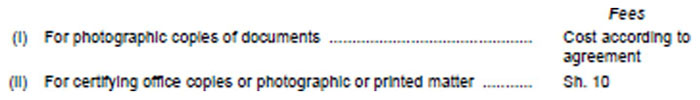

The fees payable under section 53 of the Act for certified copies of estate duty affidavits, corrective affidavits or statements and assessments provided by the Commissioner shall be as follows—

|

ESTATE DUTY (FEES) RULES, 1993 [L.N. 34/1993.]

| 1. |

These Rules may be cited as the Estate Duty (Fees) Rules, 1993.

|

| 2. |

There shall be charged and paid to the Estate Duty Commissioner a fee of five hundred shillings for the issue of a certificate of compliance or a certificate of discharge under section 49 or 50 of the Act in respect of property which passes on the death of any person dying on or after the commencement of the Act but before 1st January, 1982.

|

| 3. |

The fee chargeable under rule 2 shall not be payable by virtue of the Estate Duty (Abolition) Act, 1982 in respect of property which passes on the death of any person dying on or after 1st January, 1982.

|

|